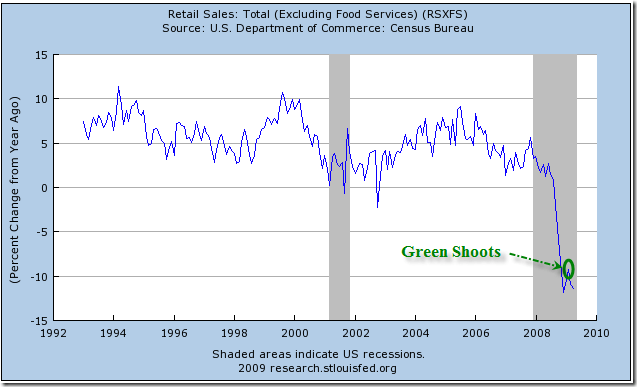

We’ve “stopped falling off a cliff.” Oh, sure, sure. Now we’re bouncing down the scree:

Housing starts unexpectedly slid 13 percent to an annual rate of 458,000, led by a 46 percent tumble in multifamily starts, which tend to be more volatile, Commerce Department figures showed in Washington. Building permits, a sign of future construction, fell 3.3 percent to a record low of 494,000.

Japan’s economy shrank record 15.2% last quarter.

“There was a collapse across the board,” said Yoshiki Shinke, a senior economist at Dai-Ichi Life Research Institute in Tokyo. Still, he added that there’s “light at the end of the tunnel” and the economy will resume growing this quarter as companies replenish inventories and stimulus plans at home and abroad take effect.

(He’s obviously a perkypants, too.)

HP Profits down 17% on declining sales in PC’s and *ink*

Mayor Daley is not a perkypants

Forget about the positive trends in the stock market and the uptick in the housing market. Where some see a ray of sunshine in the economic clouds, Mayor Daley sees an intensifying storm.

“It’s like a tsunami. It’s all coming together,” Daley said as he urged Chicago businesses to make their employees aware of government assistance programs.

“This is not a recession that we’ve seen in the past that’s one part of the economy. This is the financial industry. This is retailing. This encompasses manufacturing. It encompasses everything you see in society.”

Roubini says: Others see green shoots, I see yellow weeds.

And I think they all *know* that the economy is bouncing down the scree … which is why we have *this* suggestion becoming more popular:

U.S. needs more inflation to speed recovery

So say economists including Gregory Mankiw, former White House adviser, and Kenneth Rogoff, who was chief economist at the International Monetary Fund. They argue that a looser rein on inflation would make it easier for debt-strapped consumers and governments to meet their obligations. It might also help the economy by encouraging Americans to spend now rather than later when prices go up.

“I’m advocating 6 percent inflation for at least a couple of years,” says Rogoff, 56, who’s now a professor at Harvard University. “It would ameliorate the debt bomb and help us work through the deleveraging process.”

(Yeah, a little hyperinflation should do the trick!)

Sure wish I could past a Cartoonin comments.

OK, ok, I’m still a little doped from the surgury – paste a cartoon in comments.