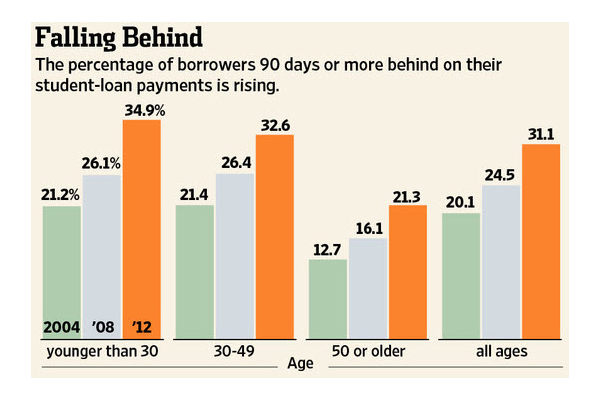

Looks like the student loan bubble is bursting. Even when Uncle Sam backstops the loans so there is virtually no risk to lenders, no one wanted the latest student loan bond offering from Sallie Mae. Considering that one-third of student loans are 90 days or more late and the bond was offering a puny 3.5%, well, would you buy them? Didn’t think so.

The real problem for the banksters is, as always, they’ve taken toxic slop loans and sliced and diced them into weird hard-to-trade securities. Suddenly those securities aren’t so safe. For example, some of them are comprised of  interest payments only from thousands of loans. If one-third of interest payments aren’t being made, then the value of the security tanks. Now ponder what happens if you are highly leveraged and own this garbage.? Everything could go screaming into the abyss, just like it did for the exact same reasons with real estate.

The government has allowed and encouraged the student loan bubble to expand so Wall Street could enrich itself. It will end as all bubbles do, with a loud pop. Then Wall Street will whine they need bailouts because who could have possibly predicted this would happen.